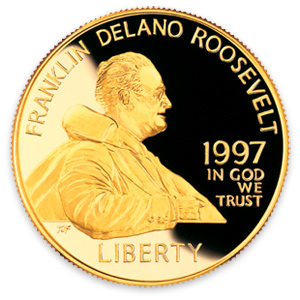

Speaking at the FT Silver conference in London yesterday, lead-off speaker John Levin, HSBC Bank's Managing Director, Global Metals and Trading (HSBC is one of the world's top precious metals traders and its vaults in the U.S. and Europe hold huge holdings of gold and silver bullion) recounted conversations with some of the U.S.'s top asset managers controlling massive amounts of capital asking if HSBC had the capacity in its vaults to store major gold purchases. On being told that the bank's U.S. vaults had sufficient space available he was told that they did not want their gold stored in the U.S.A. but preferably in Europe because they feared that at some stage the U.S. Administration might follow the path set by Franklin D. Roosevelt in 1933 and confiscate all U.S. gold holdings as part of the country's strategy in dealing with the nation's economic problems.

Speaking at the FT Silver conference in London yesterday, lead-off speaker John Levin, HSBC Bank's Managing Director, Global Metals and Trading (HSBC is one of the world's top precious metals traders and its vaults in the U.S. and Europe hold huge holdings of gold and silver bullion) recounted conversations with some of the U.S.'s top asset managers controlling massive amounts of capital asking if HSBC had the capacity in its vaults to store major gold purchases. On being told that the bank's U.S. vaults had sufficient space available he was told that they did not want their gold stored in the U.S.A. but preferably in Europe because they feared that at some stage the U.S. Administration might follow the path set by Franklin D. Roosevelt in 1933 and confiscate all U.S. gold holdings as part of the country's strategy in dealing with the nation's economic problems.While in Mineweb's view such a move is unlikely, one needs to bear in mind that President Obama is a keen follower of Roosevelt's views and policies and that the very fact that some asset managers controlling huge volumes of money feel that such a move is possible is a significant factor - and one that is perhaps heightened by the huge amounts of money flowing into gold at the moment in both ETFs and bullion.

As a reminder to readers - Section 2 of Roosevelt's Act read as follows: All persons are hereby required to deliver on or before May 1, 1933, to a Federal Reserve bank or a branch or agency thereof or to any member bank of the Federal Reserve System all gold coin, gold bullion, and gold certificates now owned by them or coming into their ownership on or before April 28, 1933, except the following:

(a) Such amount of gold as may be required for legitimate and customary use in industry, profession or art within a reasonable time, including gold prior to refining and stocks of gold in reasonable amounts for the usual trade requirements of owners mining and refining such gold.

(b) Gold coin and gold certificates in an amount not exceeding in the aggregate $100.00 belonging to any one person; and gold coins having recognized special value to collectors of rare and unusual coins.

(c) Gold coin and bullion earmarked or held in trust for a recognized foreign government or foreign central bank or the Bank for International Settlements.

(b) Gold coin and gold certificates in an amount not exceeding in the aggregate $100.00 belonging to any one person; and gold coins having recognized special value to collectors of rare and unusual coins.

(c) Gold coin and bullion earmarked or held in trust for a recognized foreign government or foreign central bank or the Bank for International Settlements.

(d) Gold coin and bullion licensed for the other proper transactions (not involving hoarding) including gold coin and gold bullion imported for the re-export or held pending action on applications for export license.

At that time of course, the dollar was exchangeable for gold at a set value ($20.67 an ounce) so compensation for such a move would have been easy to calculate. Roosevelt subsequently revalued gold to the $35 level which stood for over 30 years. Nowadays that kind of process would be a little more difficult, but perhaps not beyond the means of a government, already versed in printing large sums of money to try and re-stimulate the economy. Perhaps a figure of the average gold price over a 3 month period at a certain date would meet an initial compensation valuation, but in today's much more litigious society such a move might well fail anyway.

Indeed current economic analysis of the Roosevelt move suggests that it was not successful in helping drag the U.S. out of depression and indeed may have contributed to a recession within a depression - a pretty dire situation. It probably took World War II to end the Great Depression.

Levin's presentation - a trader's view from the coal-face as he put it - contained much anecdotal material of interest and was a refreshing change from the usual analysts' viewpoints. More of that in a subsequent article.

At that time of course, the dollar was exchangeable for gold at a set value ($20.67 an ounce) so compensation for such a move would have been easy to calculate. Roosevelt subsequently revalued gold to the $35 level which stood for over 30 years. Nowadays that kind of process would be a little more difficult, but perhaps not beyond the means of a government, already versed in printing large sums of money to try and re-stimulate the economy. Perhaps a figure of the average gold price over a 3 month period at a certain date would meet an initial compensation valuation, but in today's much more litigious society such a move might well fail anyway.

Indeed current economic analysis of the Roosevelt move suggests that it was not successful in helping drag the U.S. out of depression and indeed may have contributed to a recession within a depression - a pretty dire situation. It probably took World War II to end the Great Depression.

Levin's presentation - a trader's view from the coal-face as he put it - contained much anecdotal material of interest and was a refreshing change from the usual analysts' viewpoints. More of that in a subsequent article.

No comments :

Post a Comment